Uncertainties are swirling over what will happen to the euro if Greece or other distressed euro zone countries falter, and what impact trouble for the euro will have on the global economy.

In a recent NY Times op-ed, economist Tyler Cowen(a) paints a dire picture:

“We thus face the danger that the euro, the world’s No. 2 reserve currency, could implode. Such an event wouldn’t be just another depreciation or collapse of a currency peg; instead, it would mean that one of the world’s major economic units doesn’t work as currently constituted.”

How concerned should we be about a euro collapse? Cowen’s claims raise several questions, which I will examine in turn.

1. Does an exit of several peripheral countries from the euro zone constitute an implosion of the euro? I don’t think so. The status of the euro as a reserve currency does not depend on Greece’s membership; it depends on Germany’s management. If the alternatives are to jettison Greece – or even several of the GIPSIs – or to devalue the currency to keep them in, the euro’s status as a reserve currency might actually be improved by the exit of some of the weaker links.(b) To the extent that markets prefer stability over instability, any resolution may be preferable to continued uncertainty.

2. Would a euro-exit signal that one of the world’s major economic units doesn’t work? No. Greece is not one of the world’s major economic units.(c) A euro-exit would signal that one of the world’s major political units doesn’t work, but I’m not sure that this is new information nor am I sure that markets care all that much. What matters most is Germany, and markets’ belief in Germany’s credibility to maintain a valuable currency. The German economy is not on the verge of collapse and German policymakers have repeatedly chosen to maintain policy credibility over possibly saving peripheral members.

3. How important is the euro as a reserve currency? Roughly as important as the German mark was pre-euro, perhaps in combination with the French franc. Since its introduction in 1999, the euro has advanced little, if any, above the combined mark-franc status as a global reserve currency. There is only one truly important global currency: the dollar.1 At the end of last year global dollar holdings were nearly 250% higher than euro holdings. The introduction of the euro did little to reduce the world’s reliance on the dollar, as the euro is used in roughly the same percentage of the world’s foreign exchange trading as the mark and franc were previously.

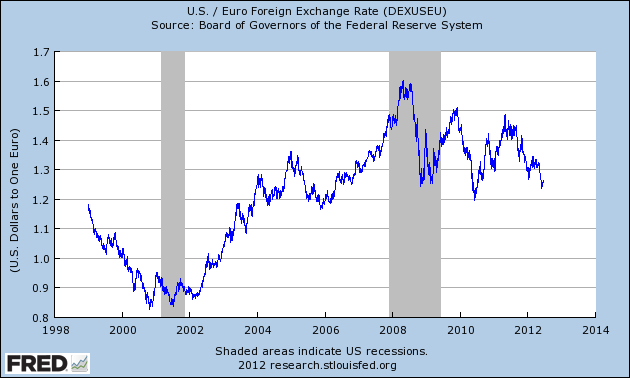

4. Do the data indicate that the euro is close to collapse? While the euro has significantly weakened since mid-2011, if we zoom out and look at a longer time series we see that it is still trading around pre-recession levels:

In his piece, Cowen also references the important role dominant countries play in the global economy: “We are realizing just how much international economic order depends on the role of a dominant country — sometimes known as a hegemon — that sets clear rules and accepts some responsibility for the consequences.” If we believe in the importance of a hegemon, then we should primarily be concerned about the US (the global hegemon) and Germany (the regional hegemon), not Europe’s southern periphery. The role of the hegemon is to stabilize the system, not necessarily to guarantee good outcomes for every constituent within it. To the extent that the economies of the U.S. and Germany remain stable, we should expect the structural integrity of the global financial system to stay intact.

Endnotes

- The structural dynamics of reserve currencies are not very well understood, but for a recent review of existing literature see: Hyoung-kyu Chey (2012) Theories of International Currencies and the Future of the World Monetary Order, International Studies Review, 14(1): 51-77.

Sidenotes

- (a) In addition to teaching at George Mason University, Tyler Cowen is a lead author of the widely read economics blog Marginal Revolution.

- (b) GISPI is an acronym for the five most troubled countries in the euro zone: Greece, Italy, Spain, Portugal, and Ireland. Alternate forms of the acronym include PIIGS and GIIPS.

- (c) Greece makes up 0.44% of the total world GDP, just below Switzerland and above Hong Kong.